Buying A Home? Let A Mortgage Calculator Do The Work

If you are thinking about selling, buying or possibly refinancing your home, you’ve probably been doing a little research into mortgage rates. It is important to not only find a home in your price range, but also to obtain a loan that matches your budget. Mortgage rates vary in different parts of the country, even within a single state. The mortgage game can be a frustrating, stressful and exhausting experience. But there is something out there to help make the process of researching rates and payments a little easier for you, and it’s free!

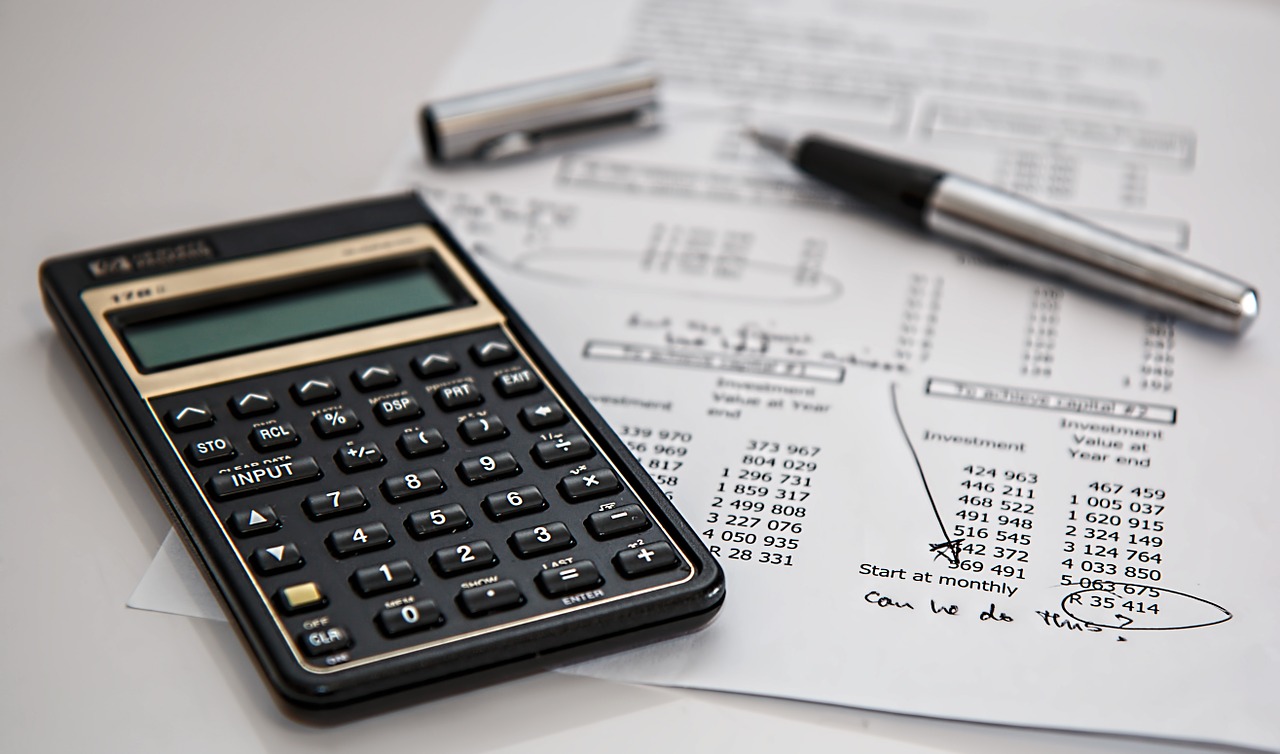

Have you ever heard of a mortgage calculator? It’s a handy, little, online device to give you some assistance in the plight to figuring out what your mortgage payments will be. The mortgage calculator bases its estimations on percentage rates, the loan amount you are receiving, and the area where you live or hope to live. They’re simple to use and can give you a pretty accurate idea of what to expect in terms of what you will be paying out each month.

There are several websites that offer the free mortgage calculator service. One excellent online resource is Mortgage101.com. Their website has an electronic mortgage calculator that not only gives you an estimation of your monthly payment based on rates and loan amounts, but offers a total of six different ways to make this determination. Based on how you would like to pay your loan, you can calculate what the payment will be based on points, percentage rates and length of the loan. You can alter any of those numbers to get different estimations and ultimately, a really good idea of what to expect in terms of financing options. By utilizing the Monthly Payment calculator, you can enter information about your property such as value, taxes and insurance requirements to receive an even more accurate estimation of what your payment might be.

Take advantage of mortgage calculators. They are a free and easy way to get a good idea of what you can expect to pay for your new home or business property. Getting this information in advance might be one way to cut down on the stress of trying to figure out the best way to finance, and give you a little peace of mind knowing, up front, what you can or cannot afford to pay.